Where To Get A Mortgage With Daca

Jim Quist is the president and founder of NewCastle Home Loans. He has twenty+ years of mortgage lending experience as a business organisation owner, mortgage underwriter, and loan officer. Jim's goal is to help people buy homes.

- by Jim Quist |

- Jul 09, 2021

Jim Quist is the president and founder of NewCastle Domicile Loans. He has 20+ years of mortgage lending experience equally a business possessor, mortgage underwriter, and loan officeholder. Jim's goal is to help people purchase homes.

How to Get a DACA Mortgage Loan

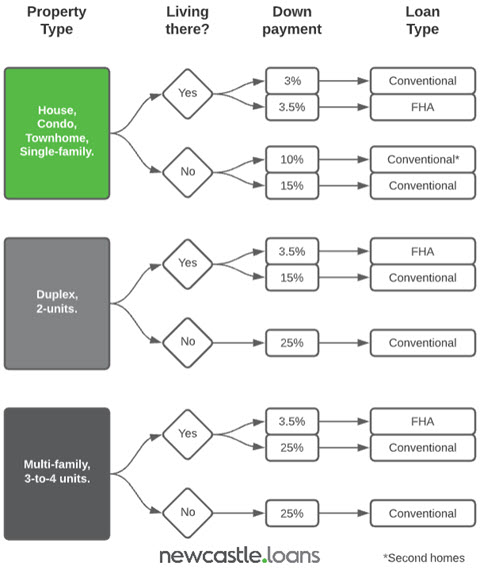

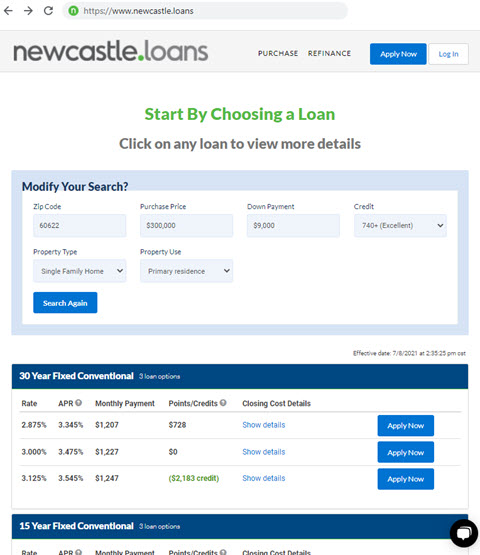

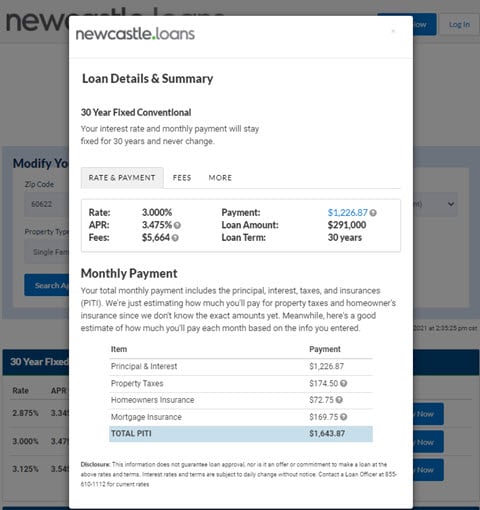

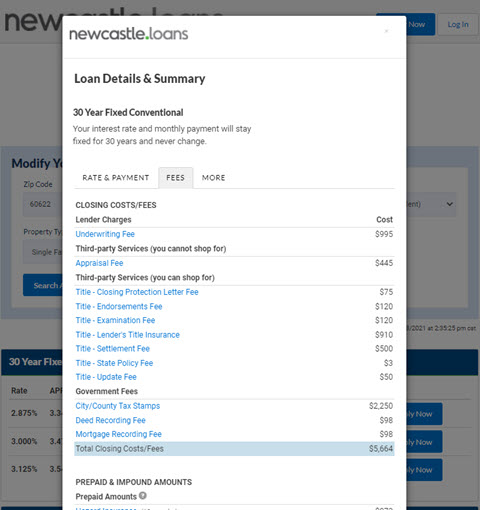

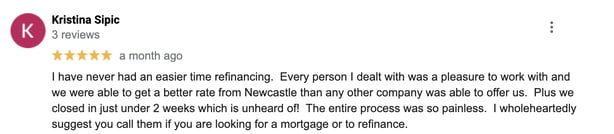

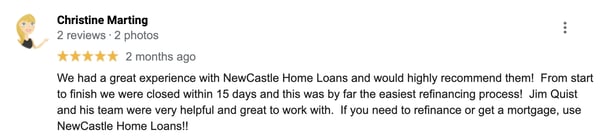

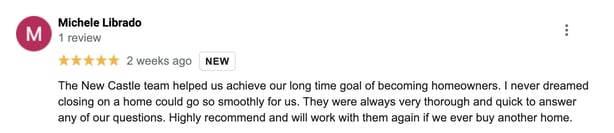

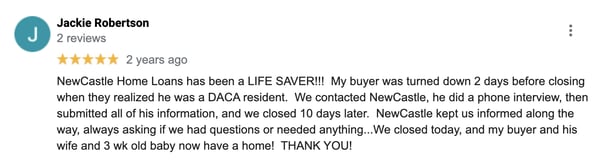

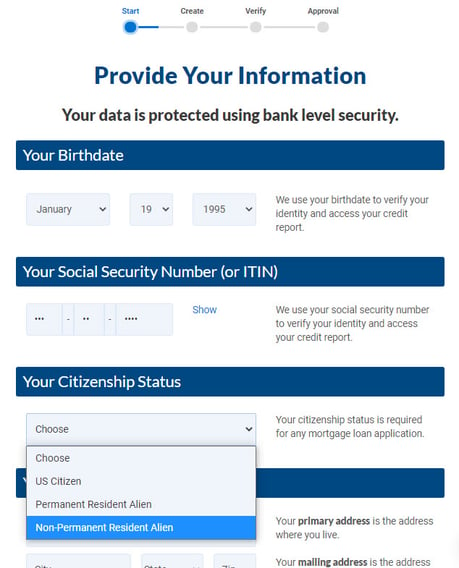

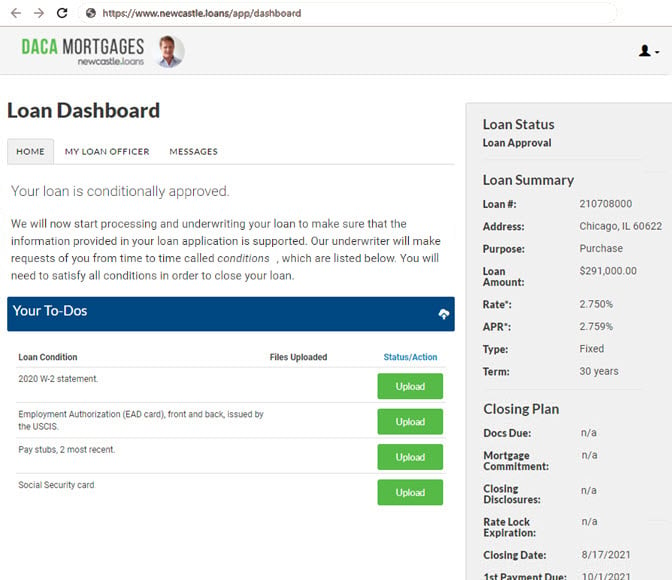

Obtaining a mortgage can be scary and hard for homebuyers in the Deferred Activeness for Childhood Arrivals (DACA) program. Nosotros totally go it. It'due south a complicated process, and you probably take lots of questions. That's why we've put together this guide: To help you understand the mortgage process and avoid the pitfalls many DACA recipients experience forth the fashion. Whether you're buying your first home, a 2nd home or investment property, or if you're looking to refinance and lower your monthly payments, check out our resource below to notice out how to get your loan through our easy, online application. While information technology's true that mortgage rules and regulations have shifted quite a chip in contempo years, nosotros've got good news! Every bit of 2021, DACA recipients tin get a dwelling house loan with the same terms and rates equally United states citizens. That said, many lenders still don't offer mortgages to Dreamers. We know this considering our customers tell us: they're oft denied by banks just considering of their DACA status. But even if a big bank turned you down, residual assured—it's still possible to achieve your goal of homeownership, and we're hither to assistance. Need a DACA loan fast? You're in the right place. We can get you the home loan you need, just like nosotros've washed for many other DACA recipients. Through our industry-leading online awarding process, you lot tin can be approved within 1-day and shut in every bit few as 10-days. Our quick process is designed to get y'all the everyman interest charge per unit and endmost costs in record time, which ways you'll take the loan you need and—best of all—an affordable payment on your very own habitation. DACA recipients are eligible for near types of mortgages if they can prove they're lawful, non-permanent residents of the U.S. In other words, as a Dreamer, yous're eligible for homeownership as long equally you have the paperwork showing that you can live and work hither legally. When yous apply, y'all'll be asked to provide proof of your legal condition with copies of a few documents: By providing these documents, you'll prove that you're eligible for a mortgage in the U.S. Only continue in mind that being eligible for a loan and being approved for a loan are 2 different things. Existence eligible to receive a loan doesn't guarantee that you'll be approved for the loan, but it'southward a crucial get-go step. We work with lots of DACA participants at NewCastle, so we know firsthand that most Dreamers are young and probably looking to buy their start abode. You're likely interested in buying or refinancing a residential house, condominium, or townhome you programme to live in. Considering this is the most common reason DACA members come up to us for a loan, we have an impressive record of success when information technology comes to unmarried-family home loans at lower rates, saving our customers money each month. But nosotros also know that every buyer'due south situation is different, and we're able to offer loans for domicile types that other lenders don't unremarkably finance for DACA recipients. In addition to single-family unit homes, we work with eligible Dreamers to provide mortgages on second homes, 2 to 4 unit of measurement backdrop, or even investment backdrop. We currently lend to DACA borrowers in Florida, Illinois, Indiana, Michigan, and Tennessee looking to buy any of these above home types. If nosotros're lending in your state, just keep in mind our few exceptions: nosotros don't finance mobile and manufactured homes, commercial properties, or cooperatives. Equally you shop for a loan, yous'll notice that your loan type and down-payment requirements differ based on the type of property you're looking to purchase and the loan types you're eligible to receive. This can all become confusing pretty fast, simply we don't want you to worry virtually unraveling all the details of your mortgage on your own. Our experienced loan officers are happy to walk you lot through the unlike dwelling and loan types, down-payment requirements, and how to determine what blazon of loan is best for y'all. Whether you're looking to exist pre-approved or already have a holding in mind, schedule a gratuitous 15-minute call to discuss your best options with our team. Before you apply, you probably desire to know how much your mortgage is going to toll. It makes sense to know what you should expect financially before diving in to a new mortgage, so nosotros've invested in tools that'll help. Basically, at that place are two sets of costs you'll be responsible for with your new mortgage: a payment you'll make each month to pay off your loan, and the cash yous demand on-hand to close on your home. Your verbal monthly payment volition depend on a few variables, including the cost of your abode, downwards payment amount, and your loan's interest charge per unit. But your monthly payment is not the just mortgage price to keep in heed. When you shut on your dwelling house, you lot'll also need cash up-front to pay closing costs, taxes, and fees. This is the part of your mortgage that often adds up, catching borrowers past surprise. Nosotros don't want doubt about involvement rates, monthly payments, or endmost costs to stand up in the way of your homeownership, so we've invested in the tools to help. Nosotros believe the home loan process should exist as transparent as possible, so we provide our Mortgage Reckoner as a complimentary tool to give you all the loan information you need ahead of fourth dimension. Our estimator lets y'all see and select loans with live interest rates, meaning yous see estimated monthly payments and closing costs to the dollar, instead of the range of possible involvement rates and monthly payments that many online mortgage calculators offer. Inspired by our client-offset processes, this technology likewise allows united states to offering you lower involvement rates, which means lower monthly payments for you. With a loan estimate in hand, you know exactly how much information technology will cost to buy your house earlier y'all even apply for the loan, and y'all can program for what's ahead with peace of mind. Kickoff, enter basic information including the estimated purchase price, downwardly payment, and credit score. You'll receive loan options with live interest rates and monthly payments—instantly. So, click "Show details" to see the total payment including the estimated property taxes and insurances. Side by side, view the endmost costs. You'll know what to wait and feel confident nigh buying a home. Shopping around for a loan but yous can't seem to go a firm number from other lenders? Just want to get an idea of how much greenbacks it'll take to go from renting to owning your own dwelling house? Accept a 2nd to input some basic data about your desired home, and yous'll receive a detailed breakdown of the cost of your mortgage. Once you accept your eligibility documents and your desired domicile all worked out, what happens then? Your side by side—and most of import—step is to utilize and be approved for your loan. These approval requirements are the same for DACA recipients equally they are for U.S. citizens: You'll need to run into the minimum required credit score, prove a history of employment, provide a tape of your income, and show that y'all take plenty coin to embrace the down payment and endmost costs. Hither'south what that looks similar: Is your score authentic? You probably take an thought of your current credit score and report from a visitor like Credit Karma. But these reports aren't always as specific or accurate as the report your lender will see. When buying a habitation, information technology's a expert idea to have a mortgage lender bank check your credit report ahead of fourth dimension. The score and report are good for 120 days, so if you plan to purchase a home within the adjacent 4 months, it's a skilful certificate to keep on hand. Not sure of your current score? Cheque for free at our link below! These qualification guidelines are standard for most borrowers beyond the mortgage manufacture. That said, nosotros appreciate that Dreamers have a dissimilar background and that most DACA recipients are young and just starting out. You've worked difficult, but you might not accept a strong credit history, might have a shorter work history, or may receive income from multiple sources. Some bigger lenders volition hesitate at these conditions, but nosotros don't want yous to worry—this doesn't necessarily mean you can't qualify for a home loan. Our squad of experienced lenders is defended to helping y'all become your mortgage. We'll work with you lot one-on-one to gather the right information and see if nosotros tin can finance or refinance your home, fifty-fifty in situations where other lenders have said no. Here are just a few instances when nosotros've been able to secure habitation loans for Dreamers with more complex qualifying atmospheric condition: Example 1: Marco got a raise. Marco has been working in retail management for 3 years, and he recently received a raise. His hourly wage increased from $sixteen/hr to $21/hour. While other, traditional mortgage lenders may use Marco's average income over the final 2 years, we used Marco's new, higher wage to mensurate his income because he has a proven history of employment at his current job. Instance ii: Isobel just started a new career. Isobel is a teacher who graduated recently and started working 2 months agone. In her new teaching job, she makes $51,000 annually. While Isobel hasn't been at her current job for the standard two years, she has an additional three years of experience studying education at the academy level. We used her current income on her mortgage application considering of her combined years of report and piece of work in the field of instruction. Example three: Alex changed jobs recently. Alex works in sales, simply recently inverse jobs. He received committee income at both his previous and current jobs. He earned $x,000 in commissions in previous years and $xx,000 over the last year. We averaged his committee earnings from both his new and erstwhile jobs over the terminal 24 months and used that amount, $15,000, to approve his home loan. Now that you know what to wait, you're ready to apply for your loan or pre-approval. Equally a DACA recipient, call back: no affair the lender, it's important to brand sure y'all ask the loan officer if the bank volition approve borrowers with DACA status. By request ahead of time, yous have a better risk of avoiding problems afterward. Still, many Dreamers begin the home loan process through a bigger lender only to be denied within weeks or days of the closing date. This more traditional arroyo to the mortgage process tin be rigid and deadening, resulting in college rates and surprise roadblocks that keep yous from closing on your home. Just if the banking company says no, make sure to cheque with a dissimilar lender—one denial doesn't necessarily hateful you lot'll exist denied everywhere. Besides oftentimes, we hear stories about DACA recipients losing out on their dream homes considering of a last-minute denial from the bank. That'south i reason nosotros've made information technology piece of cake for you to apply and be approved for a loan online, in record time, and at competitively depression rates. Don't lose out on your home because of your DACA status. Allow NewCastle become yous a faster, cheaper loan, and leave yous confident in your new knowledge as a homebuyer. Through our streamlined, web-optimized process, borrowers in Florida, Illinois, Indiana, Michigan, and Tennessee can exist approved in 1 day and shut in equally few as 10-days. Our customers can dorsum united states up on this one—nosotros know how to go your loan quickly. NewCastle has invested in a team of experts and industry-leading technology so that we can save yous money on your loan, too. We offer lower rates and lower closing costs than many bigger lenders, which means you have a lower monthly payment. Want proof? Run into our tool for live interest rates, payments, and fees. And while faster, cheaper mortgages are primal to our business, our biggest goal is to clarify the mortgage process and support our community of homebuyers. As a DACA recipient, you may have additional questions near buying a abode, and we're here to assistance. No need to spend hours of your time reading and trying to translate the ins and outs of home loans—nosotros'll walk you through the mortgage process, and we'll explain every step. Our team is dedicated to making certain you feel supported throughout your homebuying procedure, and we'll go on you informed every pace of the way. We're committed to helping Dreamers achieve homeownership, and we know nosotros can brand it happen. Check out some of the stories behind previous DACA participants who received mortgages through NewCastle: Not sure what your next steps are or if you're ready to employ? That depends on where y'all are in your homebuying process. If you take a dwelling you desire to buy and just need the loan to close the bargain, we recommend yous apply correct abroad. You lot don't want to lose out on the perfect home, and this maximizes the amount of time nosotros have to shut. If you want to buy a house just want to make certain you can go the loan showtime, we get it. That's a smart way to make sure your homebuying procedure goes smoothly. Employ below to be pre-canonical and to give yourself a competitive border when it's time to make an offering. Our pre-approval process will pre-qualify y'all so yous know exactly what to look for your desired loan amount, so give you lot a pre-approval letter of the alphabet you can requite to your real estate agent. Having this letter every bit role of your offer will let the seller know that you're serious about your offer, that you lot tin can get the loan, and that you lot'll shut speedily. Either manner, nosotros want to make your mortgage experience equally piece of cake as possible, and we're here for you—no matter where you are in the process. Follow our 3-footstep closing plan to get approved or pre-approved quickly: Fill out our online application to start the process. Exist sure to answer the question about Your Citizenship Status correctly: Non-Permanent Resident Alien. The awarding volition requite you an auto-generated approving in about 15 minutes, automatically: NewCastle'southward Approved Heir-apparent Cert is a real mortgage loan approval, and yous can become ane speedily and easily online, even before you lot shop for a abode. Here's what this step looks like: You lot'll work closely with our team as nosotros become everything ready to shut your loan: We desire to brand the homebuying process for DACA recipients as easy as possible. Have questions or desire more info before y'all apply? Schedule a free 15-minute call with me and we'll become your questions answered. You can also reach out to our squad via email or share your thoughts and questions in the comments below.

Practice all mortgage lenders offer DACA loans?

Am I eligible for a DACA mortgage?

What type of property tin can I buy with a DACA mortgage?

How much will a DACA mortgage cost?

Practise I qualify for a DACA mortgage?

Before applying for a DACA mortgage.

.png?width=616&name=Karina_Arreloa%20-%20Google%20review%20(DACA).png)

Get approved for a DACA mortgage, Step-by-Step.

Allow's get your questions answered.

Where To Get A Mortgage With Daca,

Source: https://www.newcastle.loans/mortgage-guide/daca-mortgage-loan

Posted by: mcintyrerowend.blogspot.com

0 Response to "Where To Get A Mortgage With Daca"

Post a Comment